Effortless Accounting & Tax Services

Stay compliant and focus on growth with personalized accounting solutions powered by AI. We handle the complexities of UAE tax laws so you don't have to.

Why 1TapBiz for Accounting & Tax?

Automated Compliance

Our platform automates mundane tasks like bookkeeping, VAT filing, and compliance tracking, reducing errors and saving you time.

Real-Time Insights

Gain a clear view of your finances with a real-time dashboard. Make smarter decisions with up-to-date, easy-to-understand reports.

Expert & Transparent Service

Enjoy transparent, flat-fee pricing with access to a team of qualified accountants and tax advisors when you need them.

A Full Suite of Financial Services

VAT & Corporate Tax

From seamless registration with the FTA to accurate, on-time filing of VAT and Corporate Tax returns, we ensure your business is 100% compliant with UAE tax laws.

Bookkeeping & Payroll

We manage your daily transactions, maintain clean ledgers, and handle payroll processing through the Wages Protection System (WPS) for full compliance.

Financial Reporting

Receive audit-ready year-end financial reports and monthly Management Information System (MIS) statements to track performance and make informed decisions.

Audit Assistance

We ensure your financial records are impeccable and provide full support and coordination during internal or external audits, making the process smooth and stress-free.

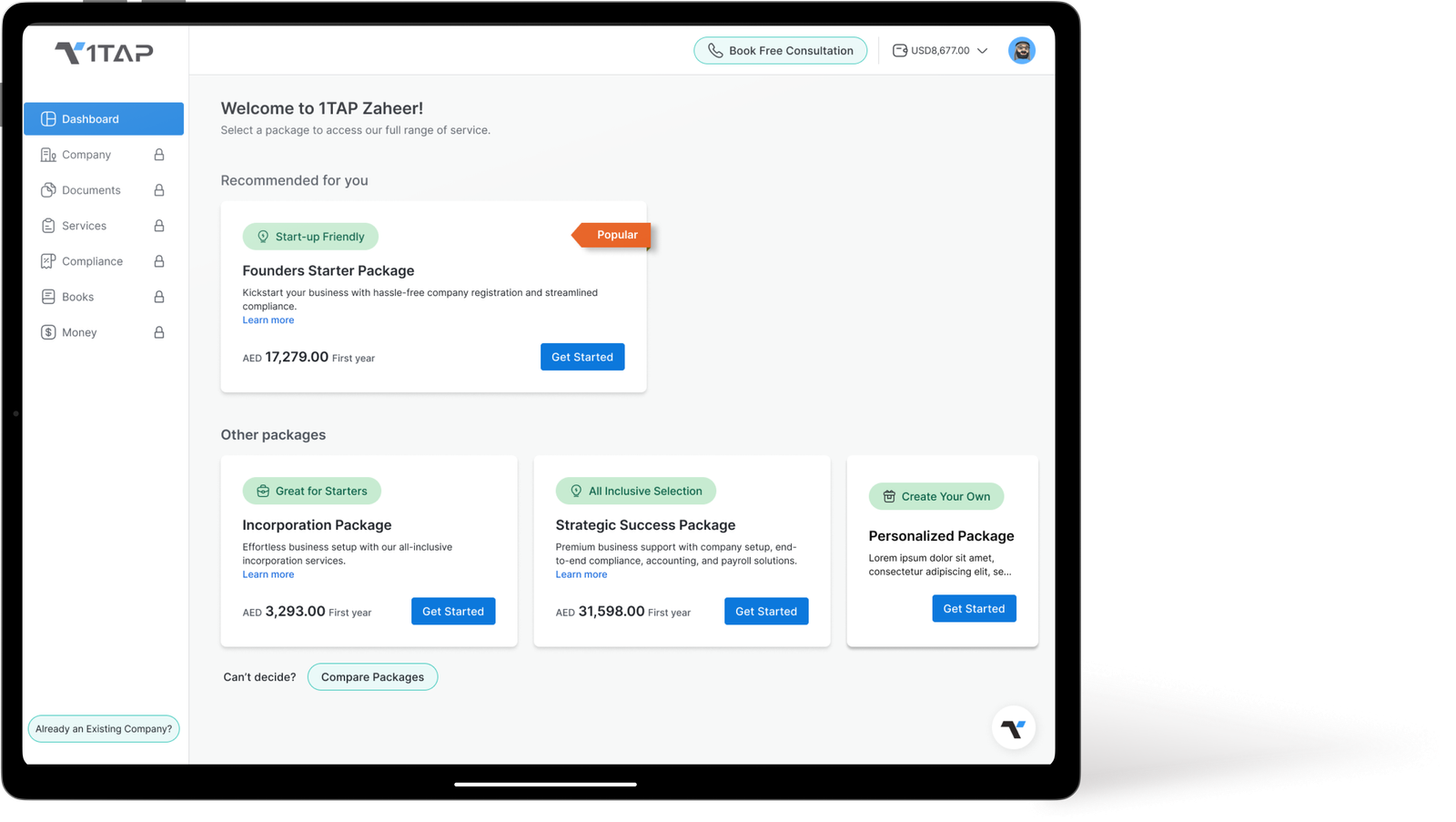

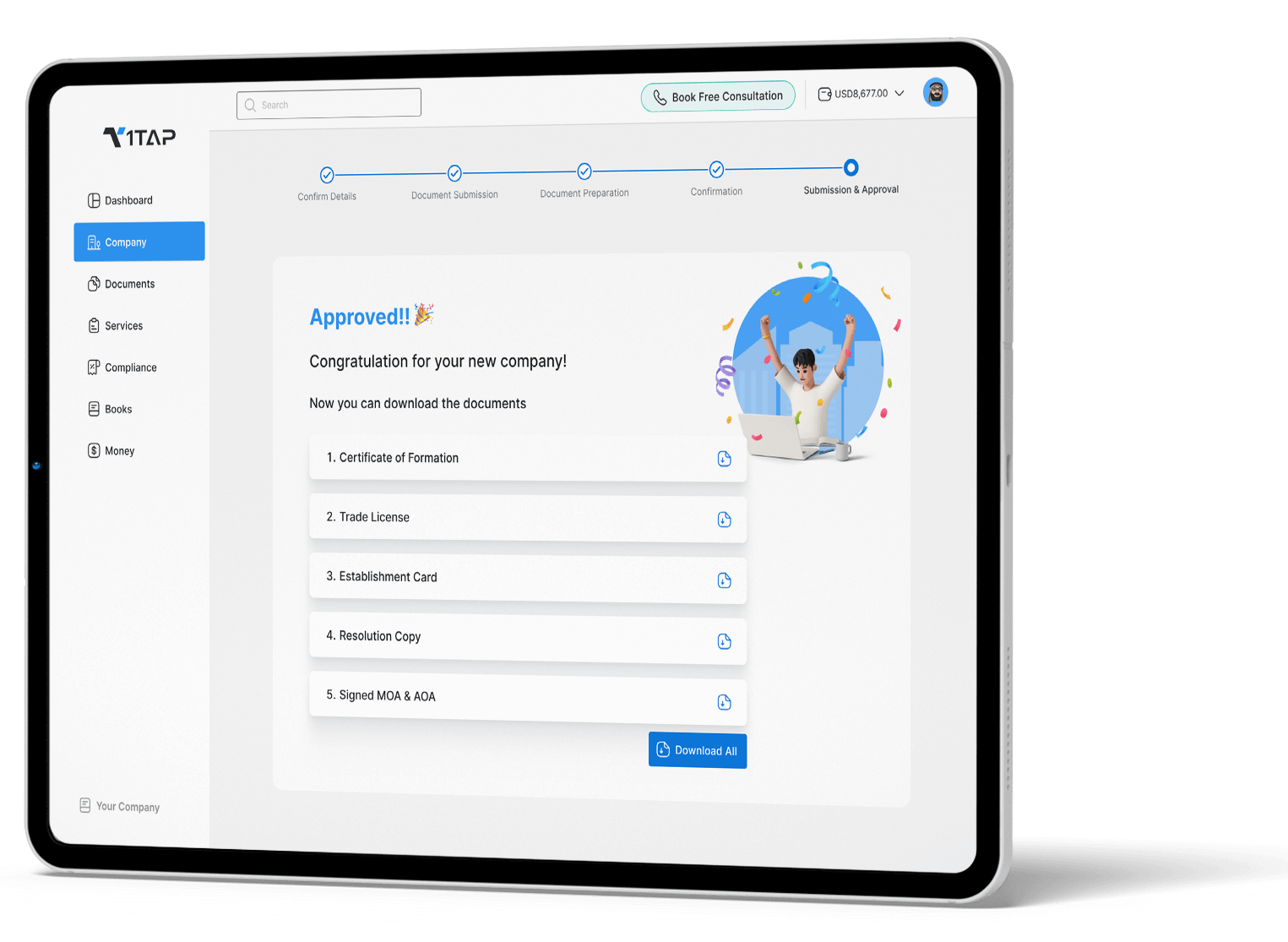

How the 1TapBiz Platform Works

-

1. Securely Upload Your Data

Easily upload invoices, bank statements, and other business data to your secure 1TapBiz dashboard.

-

2. AI Categorizes Transactions

Our intelligent system automatically categorizes and tracks your transactions, minimizing manual entry and errors.

-

3. Get Real-Time Alerts

Receive real-time compliance alerts, financial insights, and reminders for important tax deadlines directly on your dashboard.

-

4. We Handle Filing & Reporting

Our experts review the data and handle all tax filings and financial reporting with precision, ensuring you're always compliant.

The Importance of Flawless Compliance in the UAE

Navigating the UAE's VAT and Corporate Tax laws is critical. Non-compliance can lead to significant financial penalties and business disruption. 1TapBiz acts as your safeguard, ensuring every filing is accurate and on-time, protecting your business from risk and allowing you to operate with complete peace of mind.

Secure Your CompliancePotential Penalties for Non-Compliance:

- Late VAT Registration: AED 10,000

- Late VAT Return Filing: AED 1,000 for first offence

- Failure to keep required records: AED 10,000+

- Corporate Tax penalties for non-compliance can be substantial.

From Business Owners Like You

"1TapBiz took over our accounting and VAT filing, and the difference was night and day. Their platform is intuitive, and their team is always available for advice. I can finally focus on my actual business."

Fatima Al-Sayed

Founder, Local Gems E-Commerce

"Getting registered for Corporate Tax was a seamless process with 1TapBiz. They handled all the documentation and gave us clear guidance on our obligations. It's an essential service for any SME in the UAE."

Rajiv Kumar

Director, Apex IT Solutions FZCO

Frequently Asked Questions

What is the corporate tax rate in UAE?

The standard UAE Corporate Tax rate is 9% on taxable income exceeding AED 375,000. A 0% rate applies to taxable income up to this threshold to support small businesses and startups. 1TapBiz ensures your business is correctly registered and files returns in full compliance with these regulations.

Does my business in the UAE need to register for VAT?

In the UAE, it is mandatory for a business to register for VAT if the total value of its taxable supplies and imports exceeds AED 375,000 per annum. Voluntary registration is possible if the threshold is over AED 187,500. Our platform simplifies the entire VAT registration and filing process for you.

How does 1TapBiz automate bookkeeping?

Our platform allows you to securely upload or connect your business data. Our AI-powered system then helps categorize transactions, tracks income and expenses, and provides real-time financial insights on your dashboard. This reduces manual errors and prepares your books for easy reporting and auditing.